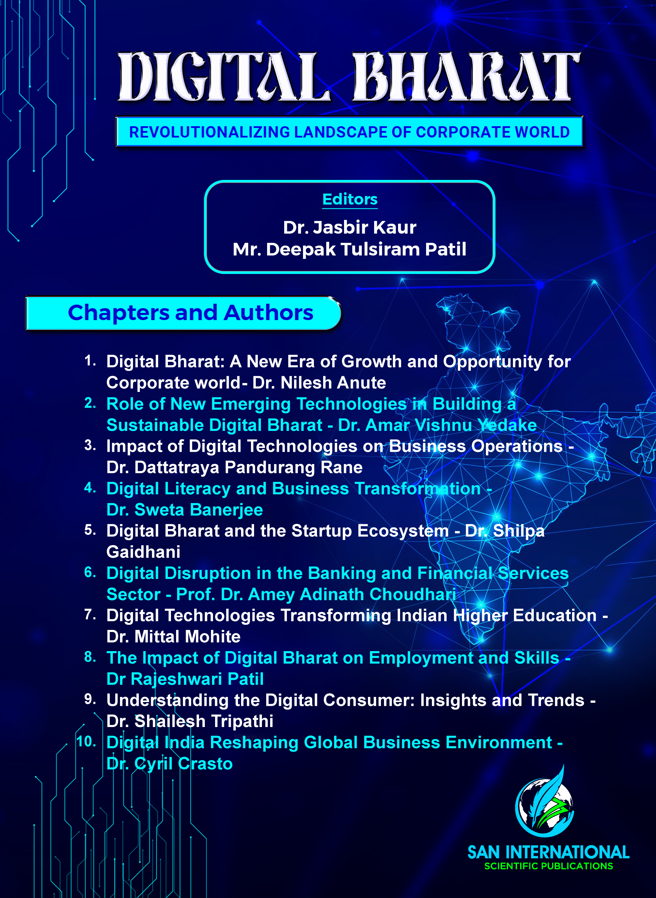

Book Title: Digital Bharat: Revolutionalizing landscape of corporate world

Editors: Dr. Jasbir Kaur and Mr. Deepak Tulsiram Patil

ISBN: 978-81-986047-1-2

Chapter: 6

DOI: https://doi.org/10.59646/dbc6/326

Author: Prof. Dr. Amey Adinath Choudhari

Abstract

There has been a sea change in the way banks and other financial institutions do business and engage with their clients as a result of digital disruption. Cloud computing, big data analytics, artificial intelligence (AI), and blockchain are just a few examples of the technological innovations that have brought about remarkable shifts, improving safety, effectiveness, and the consumer experience. With the use of statistics, case studies, and an examination of the most pressing problems confronting the industry, this article delves into the effects of digital disruption. At the end, it includes some important takeaways, questions for discussion, and resources for more research.

References

- Arner, D. W., Barberis, J., & Buckley, R. P. (2017). FinTech and RegTech in a nutshell, and the future in a sandbox. CFA Institute Research Foundation, 3, 1–20.

- Auer, R. (2019). Beyond the doomsday economics of ‘proof-of-work’ in cryptocurrencies. Bank for International Settlements Working Papers, (765).

- Beck, T., Ioannidou, V., Perotti, E., Sánchez-Serrano, A., & Suarez, J. (2024). Addressing banks’ vulnerability to deposit runs: Revisiting the facts, arguments, and policy options. European Central Bank ESRB Advisory Scientific Committee Report, (15).

- Claessens, S., Frost, J., Turner, G., & Zhu, F. (2018). FinTech credit markets around the world: Size, drivers, and policy issues. Bank for International Settlements Quarterly Review, 29–49.

- Durigan Junior, C. A., Kissimoto, K. O., & Laurindo, F. J. B. (2024). IT enabling factors in a new industry design: Open banking and digital economy. arXiv preprint arXiv:2407.09487.

- European Banking Authority. (2018). EBA consultation on the impact of FinTech on incumbent credit institutions’ business models. European Banking Authority Report.

- Frost, J., Gambacorta, L., Huang, Y., Shin, H. S., & Zbinden, P. (2019). BigTech and the changing structure of financial intermediation. Economic Policy, 34(100), 761–799.

- Klapper, L., Ansar, S., & Hess, J. (2018). The Global Findex Database 2017: Measuring financial inclusion and the Fintech revolution. World Bank Group Report.

- Lee, L. (2024). Enhancing financial inclusion and regulatory challenges: A critical analysis of digital banks and alternative lenders through digital platforms, machine learning, and large language models integration. arXiv preprint arXiv:2404.11898.

- Malkawi, W. (2019). Digital disruption could make or break the banking sector. World Finance.

- Sane S, Anute N, and Limbore N (2022) Taking Advantage of Consumer Ethnocentrism: A Potential Strategic Tool, Journal of Pharmaceutical Negative Results, Volume 13, Special Issue 9, Page no. 6905-6913.

- Stefanelli, V., Manta, F., & Toma, P. (2022). Digital financial services and open banking innovation: Are banks becoming invisible? arXiv preprint arXiv:2210.01109.

- Vives, X. (2019). Digital disruption in banking. IESE Business School Working Paper.

- World Bank. (2018). The Global Findex Database 2017: Measuring financial inclusion and the Fintech revolution. World Bank Group Report.

- World Economic Forum. (2018). The new physics of financial services: Understanding how artificial intelligence is transforming the financial ecosystem. World Economic Forum Report.

- Zavolokina, L., Dolata, M., & Schwabe, G. (2016). The FinTech phenomenon: Antecedents of financial innovation perceived by the popular press. Financial Innovation, 2(1), 1–16.