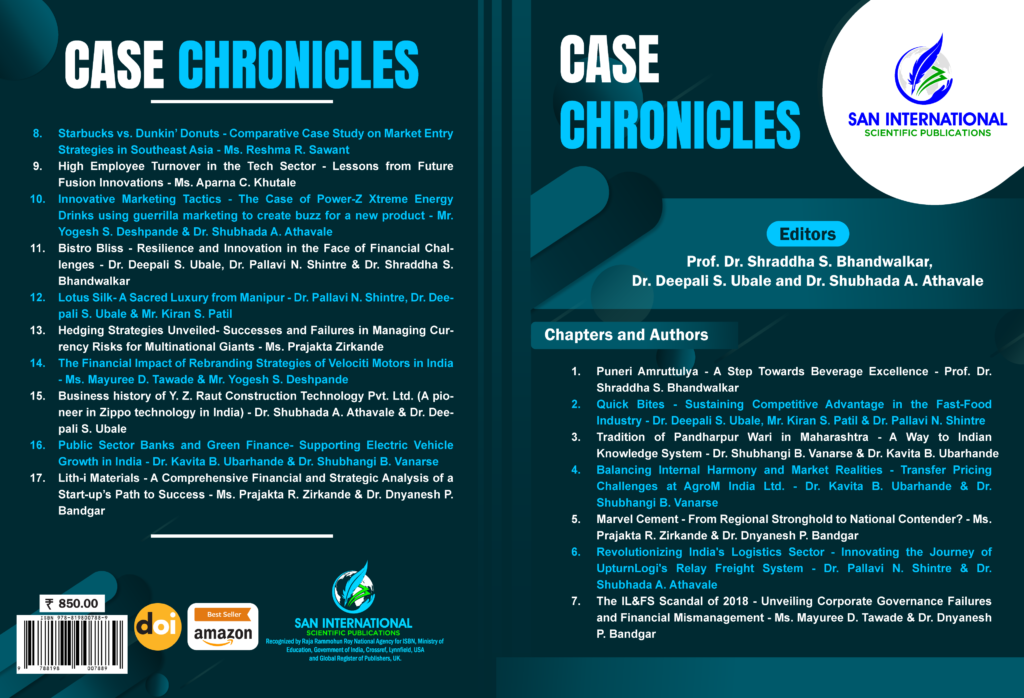

Book Title: Case Chronicles

Editors: Prof. Dr. Shraddha S. Bhandwalkar, Dr. Deepali S. Ubale and Dr. Shubhada A. Athavale

ISBN: 978-81-980078-8-9

Chapter: 13

DOI: https://doi.org/10.59646/cc13/274

Author: Ms. Prajakta Zirkande

Abstract

Currency hedging is a crucial financial strategy employed by multinational corporations (MNCs) to mitigate the risks associated with foreign exchange rate fluctuations. This study explores the effectiveness of various hedging strategies by analysing successful and unsuccessful cases from prominent corporations. It highlights the use of forward contracts, options, and swaps as common tools in managing currency risk. Successful examples, such as Coca-Cola, illustrate how a well-rounded hedging approach can stabilize financial performance amidst volatile exchange rates. The findings emphasize the importance of a diversified and adaptable hedging strategy, continuous monitoring of market conditions, and balancing the costs and benefits of hedging. Future research should focus on the impact of emerging financial instruments and technologies, sector-specific hedging practices, and the integration of advanced data analytics in risk management. These insights aim to guide MNCs in optimizing their currency risk management practices to better navigate global financial uncertainties.

Keywords: Currency Hedging, Multinational Corporations, Forward Contracts, Options, Swaps, Financial Risk Management

References

- Black, F., & Scholes, M. (1973). The Pricing of Options and Corporate Liabilities. Journal of Political Economy, 81(3), 637-654. doi:10.1086/260062

- Hull, J. C. (2020). Options, and Other Derivatives (11th ed.). Pearson.

- Madura, J. (2022). International Financial Management (14th ed.). Cengage Learning.

- Miller, M. H., & Modigliani, F. (1961). Dividend Policy, Growth, and the Valuation of Shares. Journal of Business, 34(4), 411-433. doi:10.1086/296747

- Stulz, R. M. (1996). Rethinking Risk Management. Journal of Applied Corporate Finance, 9(3), 8-25. doi:10.1111/j.1745-6622. 1996.tb00327.x

- Tufano, P. (1996). Who Manages Risk? An Empirical Examination of Risk Management Practices in the Gold Industry. Journal of Finance, 51(4), 1097-1137. doi:10.1111/j.1540-6261. 1996.tb02720.x

- Eun, C. S., & Resnick, B. G. (2018). International Financial Management (8th ed.). McGraw-Hill Education.

- Copeland, T., & Weston, J. F. (2005). Financial Theory and Corporate Policy (4th ed.). Addison-Wesley.

- Moffett, M. H., Stonehill, A. I., & Eiteman, D. K. (2017). Fundamentals of Multinational Finance (6th ed.). Pearson.

- Jorion, P. (2007). Financial Risk Manager Handbook (5th ed.). Wiley.

- Coca-Cola Company. (2021). Annual Report 2020. Retrieved from Coca-Cola’s Investor Relations.

- Smith, J. (2019). Currency Risk Management in Multinational Corporations: A Case Study of Coca-Cola. Journal of International Business Studies, 50(3), 567-589.

- Johnson, L. (2018). Global Operations and Currency Hedging Strategies at Coca-Cola. Harvard Business Review, 96(4), 102-115.

- Coca-Cola Company. (2022). 2021 Annual Report on Form 10-K. Retrieved from SEC Filings.

- Brown, K. (2020). Multinational Financial Management: The Case of Coca-Cola. Financial Management, 49(2), 345-360.

- Daimler AG. (2003). Annual Report 2003. Daimler AG.

- Brigham, E. F., & Ehrhardt, M. C. (2016). Financial Management: Theory & Practice. Cengage Learning.

- McCrum, D. (2004). DaimlerChrysler’s currency headache. Financial Times. https://www.ft.com/content/bd0b739c-03d3-11d9-9d33-00000e2511c8