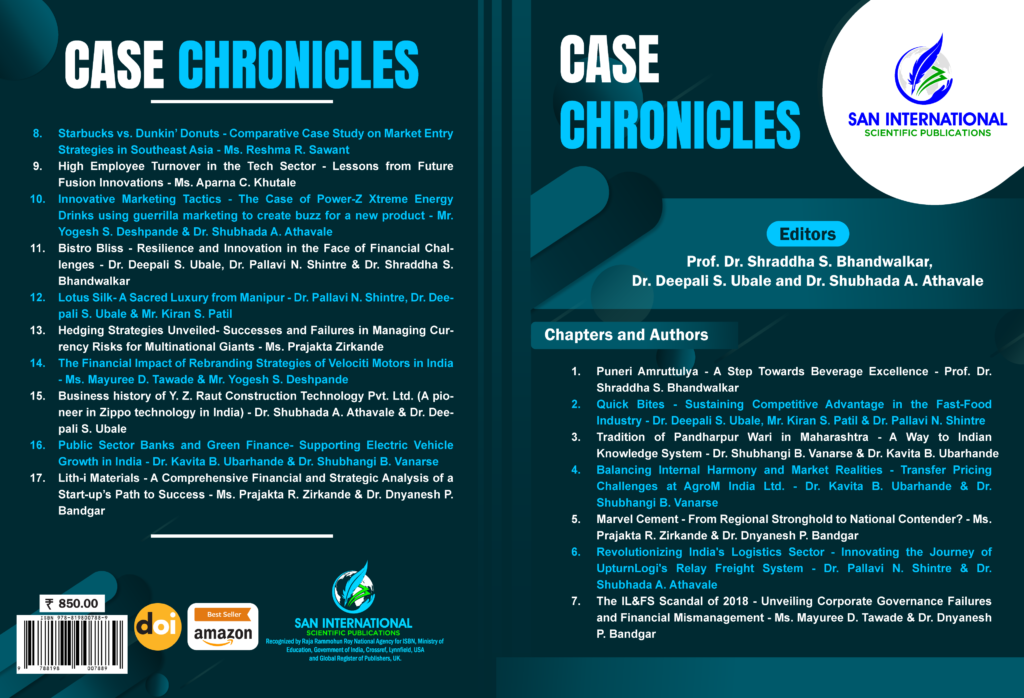

Book Title: Case Chronicles

Editors: Prof. Dr. Shraddha S. Bhandwalkar, Dr. Deepali S. Ubale and Dr. Shubhada A. Athavale

ISBN: 978-81-980078-8-9

Chapter: 17

DOI: https://doi.org/10.59646/cc17/274

Authors: Mrs. Prajakta R. Zirkande and Dr. Dnyanesh P. Bandgar

Abstract

This case study provides a comprehensive financial and strategic analysis of Lith-i Materials Scientific Private Limited, a Bangalore-based start-up specializing in advanced energy storage solutions and nanomaterials. Established in 2015, Lith-i Materials has rapidly grown through significant technological innovations, particularly in graphene-based batteries and supercapacitors, which cater to the burgeoning electric vehicle (EV) and renewable energy markets. The analysis explores the company’s milestones, from the development of its flagship RapidX battery to its strategic partnerships with major industry players like Tata Motors and Adani Green Energy. Despite its innovative edge, Lith-i faces challenges in profitability, as evidenced by its financial performance, marked by consistent losses and a high debt ratio. However, the company’s focus on R&D, market expansion, and sustainability positions it for long-term growth. The case study underscores the importance of operational efficiency and strategic capital management as Lith-i navigates the competitive landscape of energy storage technology.

Keywords: Lith-i Materials, graphene-based batteries, RapidX battery, energy storage solutions, electric vehicles, renewable energy, financial analysis, strategic partnerships, nanomaterials, start-up growth, profitability, operational efficiency, capital management, sustainability, innovation.

References

- Tracxn. (n.d.). Retrieved from https://tracxn.com

- Business Today. (2017, December 23). http://www.businesstoday.in/

- Toffler. (n.d.). https://www.tofler.in/

- Damodaran, A. (2012). Investment Valuation: Tools and Techniques for Determining the Value of Any Asset. John Wiley & Sons.

- Penman, S. H. (2012). Financial Statement Analysis and Security Valuation (5th ed.). McGraw-Hill Education.

- Palepu, K. G., Healy, P. M., & Peek, E. (2016). Business Analysis and Valuation: IFRS Edition (5th ed.). Cengage Learning.

- Azhar Kazmi (2021). Strategic Management and Business Policy, Tata McGraw-Hill

- Thompson, Strickland, Gamble & Jain (2021), Crafting and Executing Strategy- The Quest for Competitive Advantage, Tata McGraw-Hill