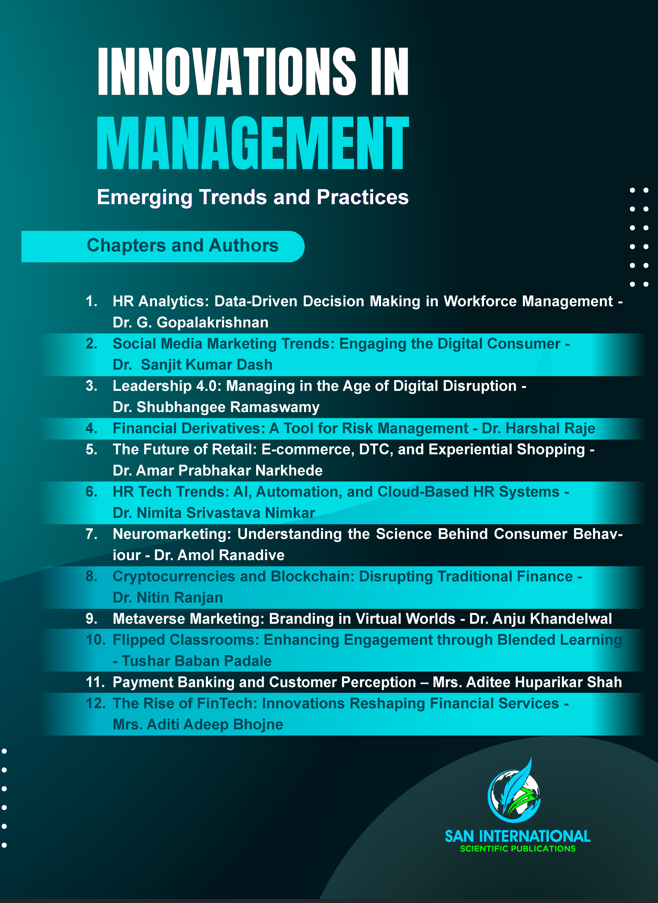

Book Title: Innovations in Management: Emerging Trends and Practices

Editor: Dr. Dattatraya Pandurang Rane

ISBN: 978-81-987266-7-4

Chapter: 11

DOI: https://doi.org/10.59646/imC11/358

Author: Mrs. Aditee Huparikar Shah, Assistant Professor. Indira college of Engineering and Management, Pune, Maharashtra, India

Abstract

Payment banking has changed the face of banking for the better by making complex financial services more accessible to those who lack traditional banking accounts via the use of technology. Services including deposits, payments, and remittances are the main focus of these financial organisations, which operate with restricted banking licenses. They stay out of the credit operations business. Customers’ opinions now matter more than ever before when it comes to the acceptability and success of payment institutions, thanks to the arrival of digital transformation in the financial industry. This chapter delves into the various payment banking models, explains their benefits, and explores customer perceptions of these models’ ease of use, security, and usability.

References

- Bansal, M., & Singh, S. (2022). Evolution of payment banks in India: A strategic assessment. Asian Journal of Economics and Banking, 6(2), 121–134.

- Chawla, D., & Joshi, H. (2019). Role of perceived trust and perceived risk in mobile banking adoption in India. International Journal of Bank Marketing, 37(7), 1471–1492.

- Kapoor, K., Dwivedi, Y. K., Piercy, N. C., & Reynolds, N. (2021). Examining the influence of customer perception in mobile banking adoption. Journal of Retailing and Consumer Services, 58, 102273.

- Sahu, G. P., Dwivedi, Y. K., & Weerakkody, V. (2020). Adoption and diffusion of mobile banking services in rural India. Information Systems Frontiers, 22(3), 703–721.

- Sharma, S. K. (2020). Impact of digital payment systems on customer behavior and perception. Journal of Financial Services Marketing, 25(1), 24–35.