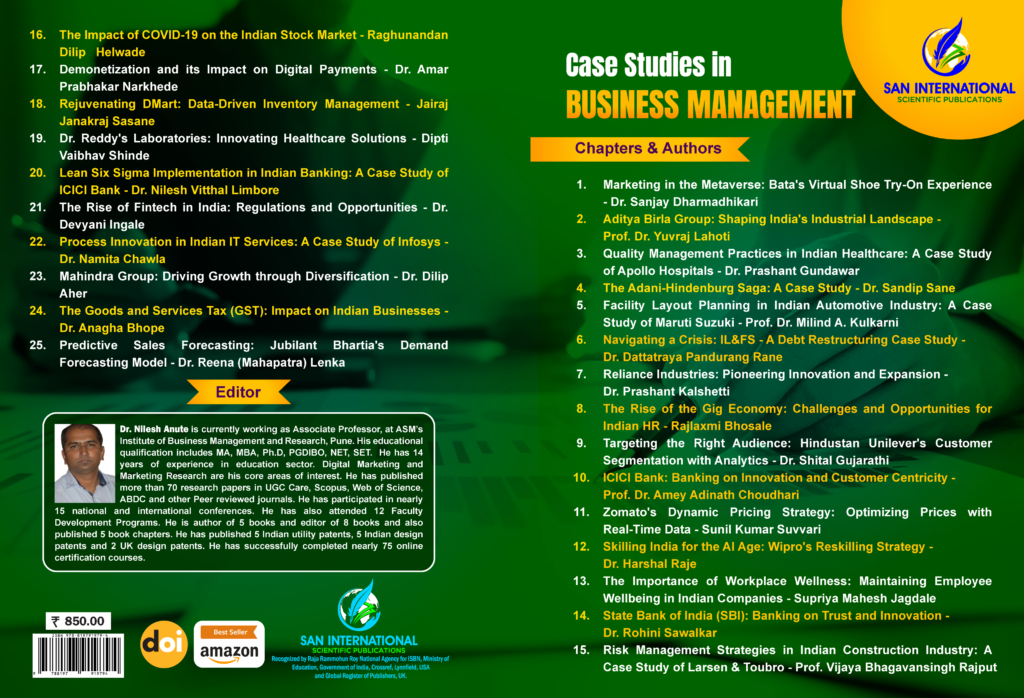

Book Title: Case Studies in Business Management

Editor: Dr. Nilesh Anute

ISBN: 978-81-979197-9-4

Chapter: 24

DOI: https://doi.org/10.59646/csc24/253

Author: Dr. Anagha Bhope, Associate Professor, Indira School of Business Studies PGDM, Pune, Maharashtra, India.

Learning Objectives

The learning objectives of this case study encompass a deep dive into the Goods and Services Tax (GST) system in India. Firstly, learners will gain a thorough understanding of the GST framework, including its key components and the types of taxes it has replaced. Secondly, they will analyze the GST’s impact on various economic sectors, assessing how different industries have responded to the new tax regime and the outcomes observed. Thirdly, the study will evaluate the benefits and challenges that Indian businesses have faced since the GST implementation, highlighting both positive effects like enhanced compliance and challenges such as increased complexity and costs. Fourthly, learners will explore how GST has simplified the tax structure by reducing tax layers and promoting transparency, thereby improving overall compliance.